First, let’s take a moment to define what a reporting company is and then we can jump into the exemptions. FinCEN defines a reporting company as follows:

The Reporting Rule requires that all “reporting companies” file BOI reports with FinCEN within the previously specified timeframes. A reporting company is any entity that meets the “reporting company” definition and does not qualify for an exemption. There are two categories of reporting companies: a “domestic reporting company” and a “foreign reporting company”. If your company is neither a “domestic reporting company” nor “foreign reporting company” because it does not meet either definition (as described below) or it qualifies for an exemption, then it is not required to file a BOI report with FinCEN.

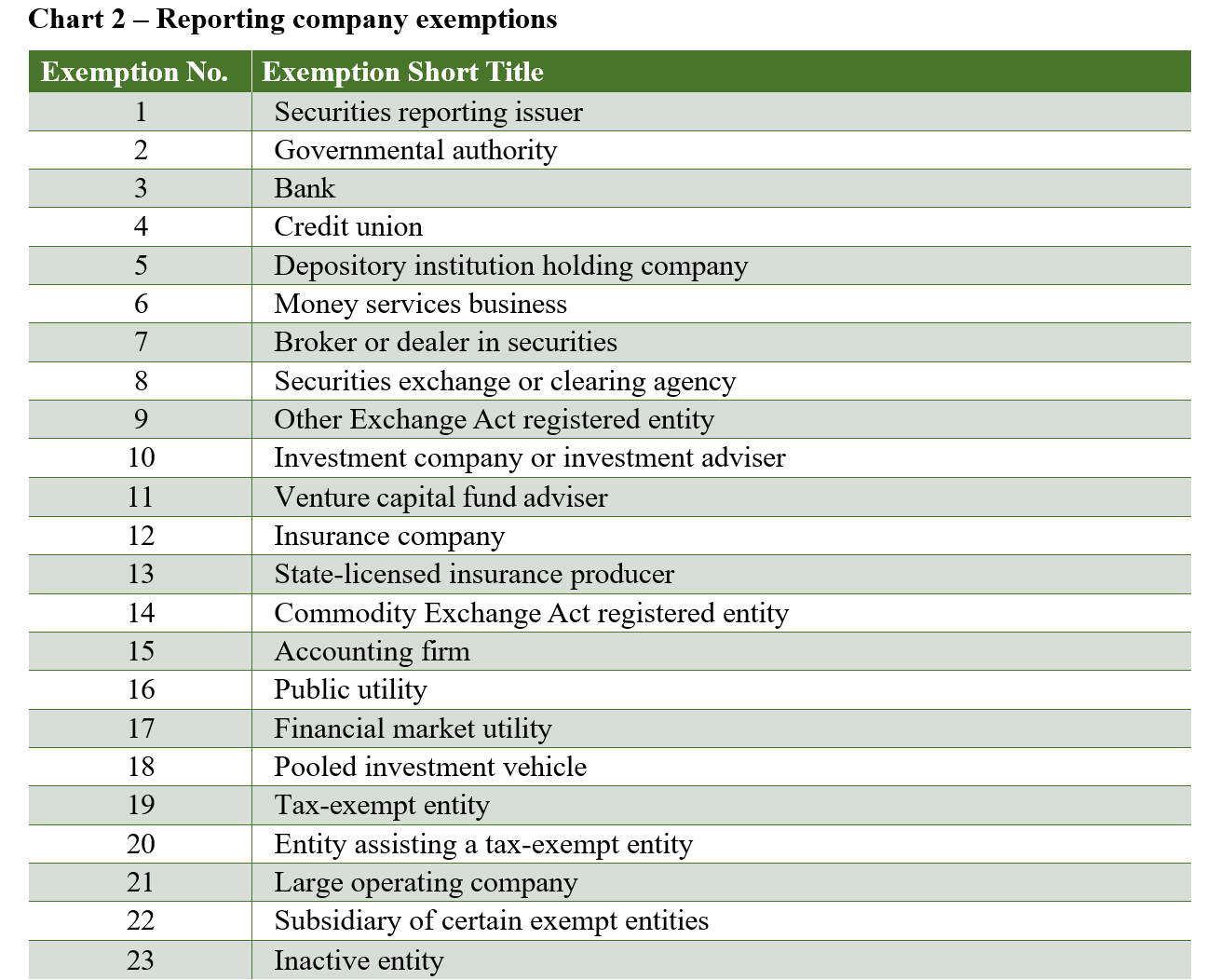

There are exceptions to every rule, and FinCEN has identified the following 23 types of entities that are exempt from filing a Beneficial Ownership Information Reports.

Exemption Number 23 is a prime example of needing a closer look. To qualitfy for that exemption, there are six criteria that must be met:

- The entity was in existence on or before January 1, 2020.

- The entity is not engaged in active business.

- The entity is not owned by a foreign person, whether directly or indirectly, wholly or partially. “Foreign person” means a person who is not a United States person. A United States person is defined in section 7701(a)(30) of the Internal Revenue Code of 1986 as a citizen or resident of the United States, domestic partnership and corporation, and other estates and trusts.

- The entity has not experienced any change in ownership in the preceding twelve-month period.

- The entity has not sent or received any funds in an amount greater than $1,000, either directly or through any financial account in which the entity or any affiliate of the entity had an interest, in the preceding twelve-month period.

- The entity does not otherwise hold any kind or type of assets, whether in the United States or abroad, including any ownership interest in any corporation, limited liability company, or other similar entity.

With so many factors to consider, it is easy for a mistake to be made. If you are unsure of your status, it is best to consult with your legal team.